FedEx has once again topped the list of the world’s busiest air cargo carriers, with the top 25 seeing demand increase ahead of the overall market, fuelled by Middle Eastern and all-cargo airlines.

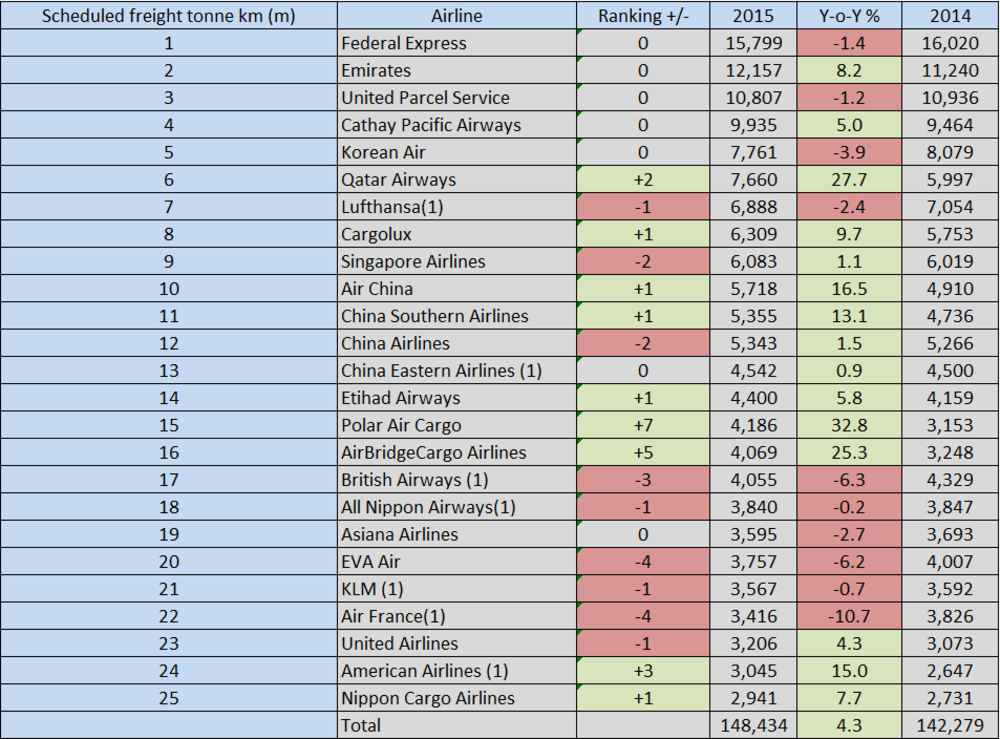

The annual IATA World Air Transport Statistics (WATS) report revealed that FedEx managed to maintain its place as the world’s busiest cargo airline despite a 1.4% decrease in demand to 15.8bn scheduled freight tonne km (FTK).

While FedEx saw package numbers increase during the year, the weight of its international priority and international airfreight shipments declined due to “weakness in global economic conditions and capacity reductions”.

The US express airline beat Emirates, which saw demand increase by 8.2% to 12.2bn FTK, to the top spot with UPS taking third place despite a 1.2% drop in demand to 10.8bn FTK.

During the year, Emirates SkyCargo increased all-cargo capacity to Mexico City, and launched new freighter services to Ho Chi Minh City in Vietnam, Ahmedabad in India, Columbus in the US, Algiers in Algeria and Ciudad Del Este in Paraguay.

Also last year, Emirates SkyCargo officially inaugurated its purpose-built cargo terminal at Al Maktoum International airport and the airline took delivery of 29 new aircraft.

Overall, the top 25 airlines saw demand increase by 4.3% year on year to 148.4bn FTK. This growth was ahead of the overall cargo market, which IATA estimates to have grown by 2.3% on 2014 levels.

The above market growth of the top 25 was generated by Middle Eastern combination carriers, scheduled freighter operators and a couple of the Chinese airlines.

The largest jump in demand came from the Atlas Air and DHL-owned Polar Air Cargo, which recorded a 32.8% improvement as it continues to benefit from its DHL contract, growth in the e-commerce and express markets, the use of higher payload Boeing 747-8 freighters and strikes at US west coast seaports at the start of the year.

“The increase is primarily reflective of growth in flying for DHL and Polar’s other customers, benefiting from an increase in higher-payload 747-8Fs in service for the Polar network and DHL,” a spokesperson said.

“The increase in B747-8F flying began during the course of 2014, so the year-over-year growth you have noted also reflects a full-year benefit from these aircraft in 2015 compared with only a part-year benefit in 2014.

“With regard to market drivers, both express and ecommerce growth contributed to Polar’s flying in 2015, as no doubt did opportunities associated with throughput issues at U.S. West Coast ports in the first part of the year.”

At a recent investor day conference, Atlas Air said it expected to fuel future growth by focusing efforts on the express and e-commerce sectors.

The increase in demand pushed the airline seven places up the list to fifteenth overall.

Qatar saw the second highest growth levels with traffic up 27.7% on a year earlier to 7.6bn FTK as it took delivery of new aircraft – including three freighters – and expanded its network.

AirBridgeCargo Airlines also recorded strong growth – up 25.3% on 2014 to 4.1bn FTK – as it took delivery of two Boeing 747-8 freighters and it continued its network expansion to the points of production and consumption.

In terms of the airlines that recorded the largest fall in demand, legacy carriers had a tough year.

Air France suffered a 10.7% reduction in demand to 3.4bn FTK and British Airways suffered a 6.3% drop to 4bn FTK as they reduced their freighter capacity.

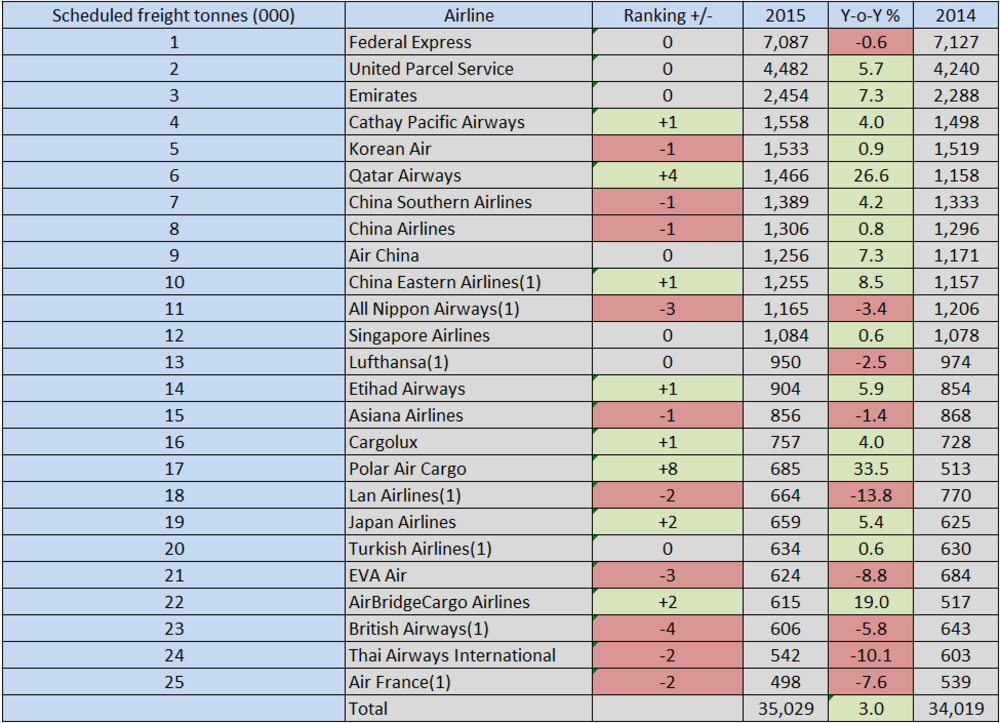

Delta Air Lines and Lan Airlines both dropped out of the top 25 list to be replaced by American Airlines and Nippon Cargo Airlines.