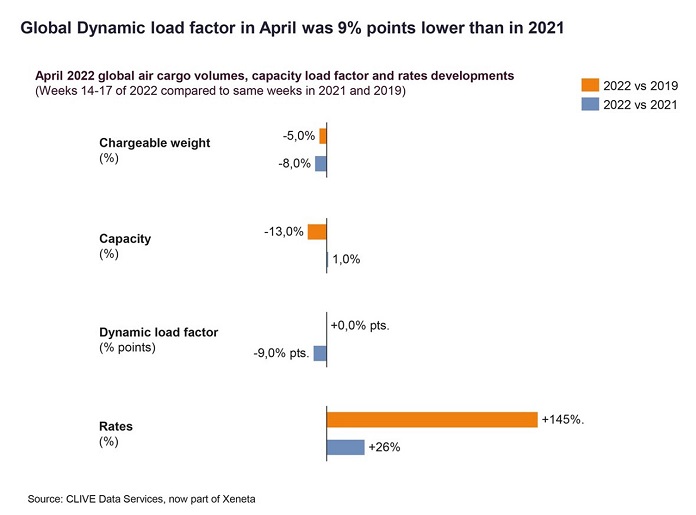

All the factors which curtailed the growth recovery of the general air cargo market in March continued to impact the industry in April with volumes at -8% year-over-year. Airfreight rates remained elevated despite the addition of new capacity, as airlines launched their summer schedules, according to the latest weekly market analysis by CLIVE Data Services, part of Xeneta.

The conflict in Ukraine, measures in China to prevent the spread of Covid, and the high cost of living all contributed to the fall in demand, which is also likely exacerbated by the staff shortages jolting airport handling services and manufacturing production. Volumes in April were -5% compared to the same month of 2019 before the pandemic took hold.

The overall reduction in CLIVE’s dynamic load factor in April 2022 – based on both weight and volume perspectives of cargo flown and capacity available to produce a true indicator of airline performance – of 9% pts to 62% partly reflected the 1% year-on-year increase in capacity. The exceptionally high load factor of 71% in April 2021 was another factor. The dynamic load factor recorded in April was on a par with the pre-Covid figure for April 2019, based on -13% less cargo capacity in the market versus three years ago.

Lower volumes last month, however, did not lead to cheaper overall airfreight rates. The +141% rise seen in March 2022 versus the 2019 level increased further in April 2022 to +145%. This was +26% above the average for April of last year.

“The rationale behind lower load factors and higher rates is the bottleneck on the ground – which appears to be being caused now by not only the shortages of people handling cargo at airports around the world and the severe lack of truck drivers to move the goods but also by a wider shortage of people for lower-paid logistics jobs. We are now seeing this larger theme impacting the entire supply chain,” said Niall van de Wouw, founder of CLIVE and now Chief Airfreight Officer at Xeneta, the leading ocean and air freight rate benchmarking, market analytics platform, and container shipping index.

Shortages of goods in stores or available online, longer lead times for some products, higher shipping costs, and flight delays and cancellations are all consequences of these market conditions, he added. The hike in living costs and lower disposable incomes for consumers are other undoubted contributors to the slowdown in volumes.

He highlighted the ‘changing of the tide across the Atlantic’. The dynamic load factor from Europe to North America averaged 70% in April 2022, a drop of 12% points in just one month, and for the first time in two years, it has fallen below 80%, according to CLIVE’s data analysis. This was caused by a big jump in North Atlantic passenger capacity as airlines stepped up their summer schedules. It is also expected to “take some of the heat out of the demand/supply market,” he said, and potentially lead to downward pressure on rates.

“During the last week of March, capacity increased by 15% compared to the previous week. This significant increase in space reinforces our previously stated forecast that the North Atlantic market will most likely be the first to return to some kind of normal, because of the high share of belly capacity on this lane. In terms of the dynamic load factor, we are seeing this shift starting to happen as we move from a Seller’s market to a Buyer’s market for air cargo. However, the issues on the ground might delay the Buyer’s market a bit longer,” he added.

The Spot rates from Europe to North America remained relatively unchanged. The Spot share – the amount of weight being sold against a short-term rate – decreased however by close to 5% points to 44% from 49% in March, again potentially indicating a softening of the market.