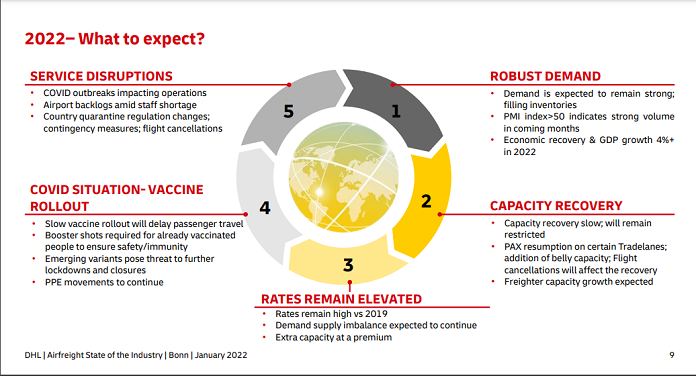

In the recent DHL report on Airfreight state of the Industry, the German logistics company Deutsche Post DHL is expecting 2022 to be a year filled with high rates than 2019. Demand is said to remain strong.

2022 is expected to be the year of economic recovery and GDP growth by 4 percent. Global capacity is still affected and is down by 17 percent vs December 2019. On the other hand, belly capacity is improved with the increase in vaccination but is still low by 28 percent as compared to the pre-covid levels. The report says that with the emergence of the Omicron variant and cancellation of the flights, the belly capacity recovery to be affected.

The COVID-19 pandemic has severely disrupted global supply chains, slowing flows of raw materials, parts and consumer goods.

Shortages of freight capacity – both ocean and air – have pushed up shipping costs globally, with the pandemic also extending port waiting times due to labour shortages and traffic disruptions.

In November 2021, air freight rates went up by 126 percent as compared to the 2019 baseline. The rates are expected to remain higher compared to the previous year. “In sea freight, we will not return to the rates we had before the coronavirus crisis.

The DHL freight unit expects the high rates to continue to buoy profits in 2022: “Our goal is to keep the operating result at least at the high level we had in the first nine months of 2021,” said Tim Scharwath. CEO, Freight, DHL Global Forwarding

The division, which employs more than 42,000 people and was once the group’s problem child, has become a profit generator under Scharwath’s direction.

DEMAND

Volume growth dipped slightly but continues to remain very strong; +14 percent Year-on-Year (YoY) growth in October 2021. E-commerce continues to contribute strongly to robust air demand. While the cargo demand remains strong along with new tech product launches and the upcoming Lunar New Year the ocean freight to air conversion is said to continue due to ocean congestion.

RATES

Rates continued to remain high as demand remains strong against capacity; ocean congestions, flight cancellations added to the woes. Rates will remain high as we continue to see limited capacity.

CAPACITY

Recovery in capacity lagged the rebound in cargo demand – the gap between supply (AFTK) and demand (FTK) appears close in a YoY comparison but remains high when compared against 2019. Resilient cargo volumes against reduced capacity led to high load factors in all regions − Freight Load Factor (FLF) is an indicator of how tight is the demand-supply balance.

Industry-wide FLF in November 2021 grew by 6 percentage points compared to pre-crisis November 2019. There was a slight dip in demand growth that made CLF (Cargo Load Factor) less tight in November 2021 and the capacity still remains restricted.