April 2021 may be remembered by some as the month in which at least part of the air cargo figures returned to some kind of normality, reveals WorldACD. Although worldwide volumes were up by 53 percent and wide-body capacity by a ‘matching’ 51 percent year-over-year (YoY), air cargo increased by a much more ‘normal’ 3 percent when compared to April 2019. Yet, it is not unjustified to speak of a business continuing to be turned upside down, as many other measures were not even near ‘normal’.

The average rate/kg went up from an already ‘unheard of’ level of $3.12 in March to $3.30, even though it came down by 12 percent from the crazy level of April 2020. Wide-body freighter capacity increased by 1 percent YoY, but what to think of the changing role of widebody passenger aircraft? They produced one-fifth of total cargo capacity in April 2020, when many passenger flights were cancelled.

A year later, the figures are completely different: in April 2021, cargo capacity on w/b passenger aircraft almost tripled YoY and comes very close to the total capacity produced on widebody freighters.

Breaking down some of our data, we see that product categories showed varying YoY-results in April. General cargo (+61 percent), live animals (+78 percent), and flowers (+67 percent) did better than average, as the latter two categories also managed to further increase their rates compared to April 2020! The usual drivers of special cargo did not fulfill their role this month: vulnerable/high-tech (+30 percent) and pharma (-3 percent) were lagging far behind the average growth of 53 percent realized this month, but they increased most when comparing them with April 2019.

Contrary to what one may have thought, the market share of the world’s 20 largest forwarders did not change, even though three fell out of the group to be replaced by three others. Growth percentages within this group varied between 17.5 percent and 130 percent.

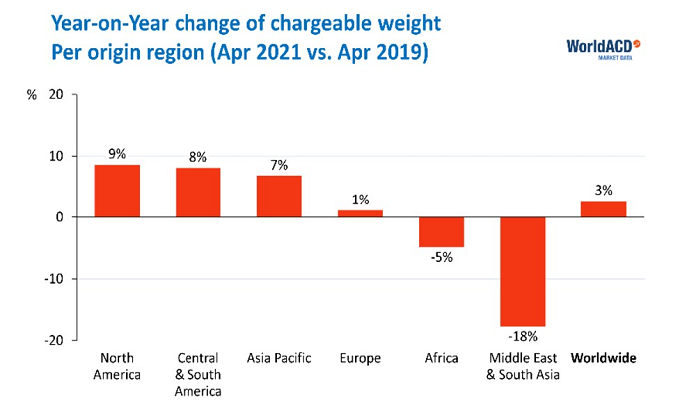

Although the question by definition cannot be answered, many people would like to find out what would have happened without Covid. Trying to make any sense of air cargo developments, calls for comparing this year with the pre-Covid-year of 2019., which leads to the following overview for the month of April:

The Americas actually gained most in air cargo exports (+8 percent), a bit more than the Asia Pacific (+7 percent) and Europe (+1 percent). Africa (-5 percent) and the Middle East & South Asia (MESA, -17 percent) were less fortunate. One level lower, we see Mexico (+14 percent), North-East Asia (+12 percent), and USA (+10 percent) as clear winners, whilst Australasia (-27 percent), the Gulf Area (-22 percent), South Asia (-19 percent) and Southern Africa (-17 percent) show seriously weakened positions.

Continuing this Yo2Y comparison, the growth of the express business has been most impressive (+59 percent), shipments in excess of 5,000 kilograms increased by 32 percent, reflecting the growing importance of charters during the Covid-period. All other so-called ‘weight breaks’ showed a volume decline. Rates are still 83 percent up worldwide, but continue to show very large regional differences: from the Asia Pacific, they have more than doubled (+117 percent), but from the Americas and Africa they increased by 30 percent only.

Judging by some daily news messages, one would think that the rate increases from China to Europe (+117 percent) and to North America (+152 percent) are in a class of their own. Yet, this view completely overlooks the fact that rate increases from Europe to North America were 137 percent. A look at the 20 largest country-to-country markets, shows that rates in markets other than those originating in the Asia Pacific more than doubled from Germany to USA Midwest and from Germany to USA Atlantic South. In the other Top-20 markets, rate increases were comparatively modest.

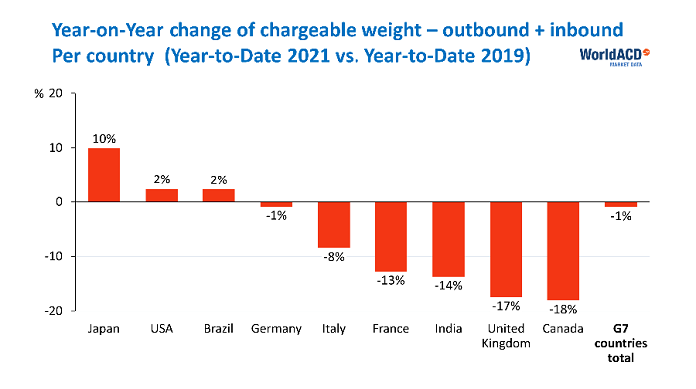

Did the world’s largest economies outside China weather the Covid-storm? Looking at the overall air cargo performance (export + import) in the first 4 months of 2021 compared to 2019, India lost 14 percent in volume, the group of G7-countries lost 1 percent, while Brazil gained 2 percent. In the G7, Japan was by far the most successful (+10 percent), followed by the USA (+2 percent). The other five G7 members (Germany, Italy, France, the UK, and Canada, in that order) notched up decreases ranging from -1 percent to -18 percent.