Global airfreight tonnage retreated for a second consecutive week in week 32, slipping -2% from the previous week, which had been -1% below the chargeable weight of week 30, based on the more than 500,000 weekly transactions covered by WorldACD’s data. Only Africa (+3%) and Central & South America (+1%) showed growth, whereas volume contracted out of North America (-5%), Middle East & South Asia (-4%), and Europe (-3%). Tonnage from the Asia Pacific was unchanged. Apart from a +1% gain in week 30, global airfreight volume has retreated in three of the past four weeks in low increments.

The decline in week 32 marks a deterioration in comparison with the last two weeks, with the preceding two weeks (2Wo2W), which shows a small decrease of -1%. When comparing week 32 with the same period last year (YoY), chargeable weight was up from all regions, except Europe and Africa (both remained stable), led by Asia Pacific (+7%) and Central & South America (CSA, +6%).

On a 2Wo2W basis, traffic from Asia Pacific was flat intra-region and retreated to North America (-2%), the Middle East & South Asia (-3%), and Europe (-5%). Origin region Middle East & South Asia (MESA) saw flat traffic to Europe and a -9% drop to Asia Pacific. Chargeable weight out of North America was flat to CSA, slipped -2% to Europe, and saw a steep decline to Asia Pacific of -11%.

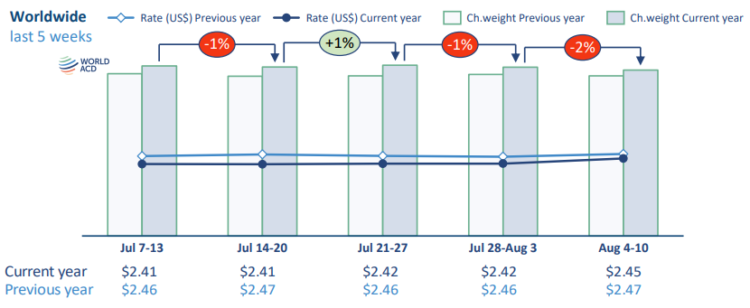

| As global capacity was largely unchanged week on week (WoW), global pricing rose +1%. This was driven by higher rates out of Europe (+3%) and Asia Pacific (+1%). YoY pricing was down -1% overall, falling in all origins except Africa (+9%) and Europe (+7%). While rates from Asia Pacific, CSA, and North America are down in low single-digit percentages, they are -14% lower out of MESA, reflecting some normalization from the soaring rates seen a year earlier due to the Red Sea crisis. With the exception of a +7% jump in pricing from CSA to Europe and a -4% contraction in rates MESA to Europe, rate fluctuations between regions in 2Wo2W have played out in a narrow band in line with the slow season. |

| Asia Pacific export dynamics shift slightly from Europe to the US |

| Export tonnage from Asia Pacific to Europe and North America hints at divergent trends, with chargeable weight in the former sector slipping -1%, marking four consecutive weeks of decline. Although westbound tonnage from Japan, Hong Kong and Taiwan rose, it sank -3% out of China and fell in double digits from South Korea (-10%) and Indonesia (-18%). Tonnage out of China to Europe has fallen for the past four weeks. Still, YoY volume from Asia Pacific to Europe was up +7%, mainly driven by gains of +29% from Vietnam, +21% from Hong Kong, and +8% from China. In contrast to the recent slowdown in Europe-bound tonnage, chargeable weight from China to the USA grew +1% WoW, following flat growth in week 31 and a +5% increase in week 30. After being under last year’s volumes since mid-April, this is the first week now showing a YoY growth of +5%. The opposing developments in sectors to Europe and North America suggest a potential rebalancing of Chinese airfreight exports and a re-engagement with the USA as more tariffs are finalized. Nevertheless, spot rates from China to the USA are still -11% lower than a year ago, despite a +5% rise WoW. Pricing from Asia Pacific to the USA rose +2% WoW but remains -14% down year on year, reflecting stark contrasts between trade lanes. Rates from Taiwan to the USA jumped +9% WoW but dropped -5% out of South Korea and -2% each from Japan, Vietnam, and Singapore. South Korea’s -5% drop in pricing followed a slump of -10% the previous week, which erased previous YoY gains. Taiwan is the only market in the region to show higher rates (+9%) to the USA on a year-on-year basis. Declines range from -8% in prices out of Thailand to -29% out of Vietnam. Spot rates from Asia Pacific to Europe showed less turbulence, being stable versus last week and down -3% YoY. Week-on-week declines out of China (-3%), Hong Kong and Singapore (-2% each), South Korea, Taiwan, and Thailand (all -1%) were compensated by increases from Vietnam (+4%), Japan, Malaysia, and Indonesia (all +3%). Pricing from Asia Pacific to Europe has shown little change WoW since a -5% drop at the beginning of May. Rates have been down compared to the previous year for the most part since the second week of June. In week 32, Thailand (+2%) and Japan (+1%) are the only Asia Pacific origin markets showing higher rates to Europe on a YoY basis. |