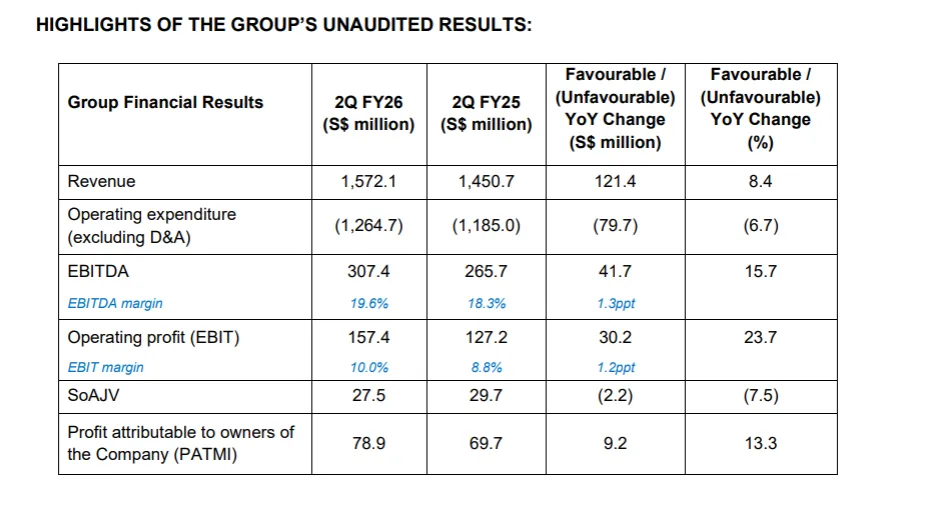

- SATS Ltd. reported a 13.3 percent year-on-year increase in net profit for Q2 FY26, reaching S$78.9 million, supported by strong cargo growth and disciplined cost management. Revenue rose 8.4 percent to S$1.57 billion, driven by a 10.7 percent increase in Gateway Services. Operating profit climbed 23.7 percent to S$157.4 million, with EBITDA up 15.7 percent.

- For the first half of the year, net profit stood at S$149.8 million, while revenue reached S$3.08 billion. SATS’ CEO Kerry Mok highlighted ongoing investments in automation, digitalisation, and talent as the company builds a next-generation air hub in Singapore. An interim dividend of 2 cents per share was declared, payable on 5 December 2025.

SATS Ltd delivered a resilient second quarter, posting a net profit of S$78.9 million for the three months ending 30 September 2025, underpinned by sustained cargo volume strength across key global markets and further improvements in operational efficiency.

The aviation services and cargo handling group reported revenue of S$1.57 billion, up 8.4% year-on-year, as Gateway Services continued to outperform global benchmarks and Food Solutions maintained stable growth in line with expanding Asia-Pacific travel demand.

EBITDA increased 15.7% to S$307.4 million, with margins improving from 18.3% to 19.6%, reflecting stronger operating leverage. Operating profit rose 23.7% to S$157.4 million, pushing EBIT margins into double-digit territory at 10%, compared with 8.8% a year earlier.

The Board declared an interim dividend of 2 Singapore cents per share, payable on 5 December.

Cargo Outperformance Drives Growth

Gateway Services remained the standout business line, with revenue increasing 10.7% year-on-year to S$1.22 billion. SATS noted that cargo volumes once again exceeded IATA’s global growth indicators, with the company’s network-scale, customer mix and geographic positioning contributing to market share gains.

Food Solutions generated S$356.5 million in revenue, up 1%, maintaining steady inflight catering demand across the region. Growth was tempered by pricing adjustments implemented in the prior year.

Group expenditure (excluding depreciation and amortisation) rose 6.7% to S$1.26 billion, remaining well-contained relative to revenue expansion.

Though contributions from associates and joint ventures declined 7.5% to S$27.5 million, SATS attributed the dip to ramp-up costs linked to new customer onboarding.

1H Performance: Strong Fundamentals and Margin Expansion

For the first half of FY26, SATS posted revenue of S$3.08 billion, up 9.1%, with operating profit rising 17.7% to S$282.6 million. PATMI for the period increased 11.2% to S$149.8 million.

Year-to-date EBITDA margin improved to 18.9%, while EBIT margin increased to 9.2%, reinforcing the benefits of sustained cargo growth, network optimisation, and cost discipline.

Strengthened Balance Sheet and Cash Flow Recovery

As at 30 September 2025, total equity rose to S$2.9 billion, supported by strong half-year earnings. Total assets stood at S$8.89 billion, while liabilities decreased S$128.5 million, driven largely by lower payables and the repayment of S$100 million in medium-term notes.

Operating cash flow after lease repayments improved significantly to S$123 million, reflecting stronger operational performance and effective working capital management. Free cash flow, while slightly negative at S$1.1 million, marked a substantial improvement over the previous year.

Global Network Expansion and Operational Upgrades

SATS continued to strengthen its global network during the quarter, advancing several strategic initiatives tailored to e-commerce and forwarder-driven demand flows:

- A new E-commerce and Freight Forwarder Handling Facility opened at Copenhagen Airport, expanding the Group’s European footprint.

- The Group renewed its Air China Cargo contract in Liège, reinforcing its role in a critical European cargo hub.

- Major onboarding and operational ramp-ups included Emirates SkyCargo and eDirect Transport at Frankfurt Cargo Services, and Turkish Airlines operations at JFK Airport’s Building 260.

In Singapore, SATS unveiled its Hub Handler of the Future programme—an initiative designed to transform ground operations through automation, workforce innovation and digitalisation. Meanwhile, Marina Bay Cruise Centre Singapore completed a S$40 million upgrade, improving capacity for dual-ship calls and elevating passenger flow efficiency.

These initiatives, the company said, reflect SATS’ broader ambition to shape next-generation air and sea gateway infrastructure for Singapore.

CEO Outlook: “Resilience and Disciplined Execution”

Kerry Mok, President and CEO of SATS, noted that while quarterly volumes were strong, the Group remained cognisant of front-loading effects ahead of tariff changes.

“Our second quarter results were enabled by a global network and consistent execution across our operations,” Mok said. “We are actively managing capacity and resources as demand patterns evolve.”

He added that SATS continues to invest in specialised handling capabilities and collaborative customer partnerships across its stations.

“Singapore remains at the heart of our multi-year transformation. We are building the foundation for next-generation mega-hubs that integrate technology, innovation and talent to redefine travel and logistics.”

Looking ahead, SATS expects shifting global trade patterns to continue influencing shipment timing and route dynamics. The Group emphasised operational discipline, network optimisation and targeted capability development as key levers to capture future growth.

IN BRIEF

SATS Ltd. reported a strong performance for the second quarter of fiscal year 2026 (2Q FY26), with net profit increasing by 13.3% year-on-year to S$78.9 million, primarily driven by strong cargo volume growth across its global network.

Key Financial Highlights (2Q FY26 vs. 2Q FY25)

| Metric | 2Q FY26 (S$ million) | Year-on-Year Change (%) |

|---|---|---|

| Revenue | 1,572.1 | +8.4% |

| Operating Profit | 157.4 | +23.7% |

| Net Profit (PATMI) | 78.9 | +13.3% |

| EBITDA | 307.4 | +15.7% |

Drivers of Growth

- Strong Cargo Momentum: The Gateway Services segment, which includes air cargo handling, was the main growth engine, with revenue increasing by 10.7% to S$1.22 billion. Cargo volumes outperformed IATA benchmarks, with strong performance noted across Asia, Europe, and the Middle East, partly due to accelerated customer shipments ahead of new tariffs.

- Operational Efficiency: The increase in operating profit and an expanded EBITDA margin (from 18.3% to 19.6%) were attributed to favourable operating leverage and operational efficiency gains from volume growth.

- Steady Food Services: The Food Solutions segment reported a stable 1.0% revenue growth to S$356.5 million, supported by steady airline catering demand and enhanced cruise services.

- Strategic Expansion: SATS has been investing in specialized handling capabilities and new facilities, such as an e-commerce and freight forwarder handling facility in Copenhagen Airport, and has onboarded new key customers like Emirates SkyCargo and Turkish Airlines.

SATS declared an interim dividend of 2 Singapore cents per share, payable on December 5, 2025. The company continues to focus on automation, digitalization, and disciplined cost management to navigate evolving trade flows