The sharp rise in demand for air capacity through the strong re-emergence of air cargo in 2021, after 2020’s supply chain devastation caused by market lockdowns, has catapulted Kuehne+Nagel (K+N) to the top of the freight forwarder rankings. 2021 – a bumper ride for air freight forwarders in terms of revenue, profits, and volumes touching new heights, also witnessed a change at the top as Kuehne+Nagel beats DHL for the top spot.

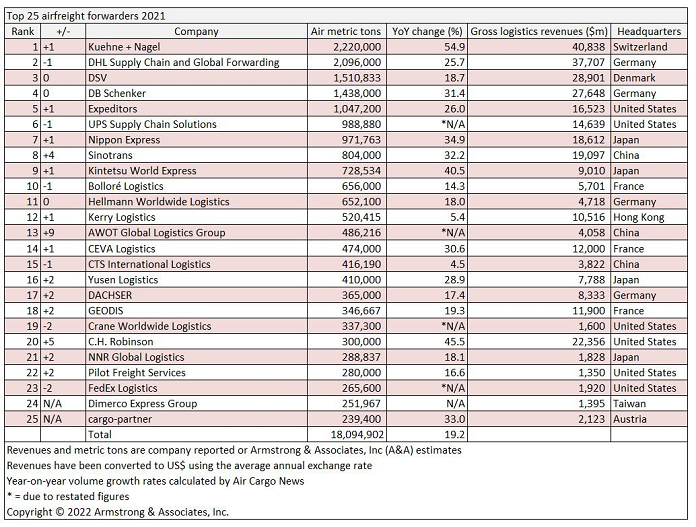

As per the latest annual statistics from consultant Armstrong & Associates, Kuehne+Nagel (K+N) was the world’s largest airfreight forwarder in terms of volumes in 2021 as it recorded a 54.9% increase to 2.2m tonnes.

The large increase came as 2021 was a bounce-back year following the worst of the Covid pandemic that saw demand fall and large swathes of capacity taken out of the sky as passenger fleets were grounded and cargo carriers had to find new ways to transport shipments.

Economic recovery after the pandemic also boosted demand, as consumers’ spending on goods increased as services were still limited by the pandemic.

Congestion at ports and container shortages also brought a modal shift giving a push to airfreight.

K+N also yield benefits from the acquisition of Apex Logistics. The first-time consolidation in May 2021 of airfreight provider Apex Logistics accounted for around half of the growth.

At the time of acquisition, K+N said Apex handled around 750,000 tonnes of air cargo per year.

“Limited global freight capacity in 2021 called for customized solutions from the Air Logistics business unit. Demand remained strong for K+N’s services in areas such as pharmaceuticals, essential goods, and e-commerce. This enabled the business unit to gain significant market share,” K+N said.

It added: “In 2021, the increased demand for air transport services was generated from a solid economic rebound but also challenges in sea freight supply chains; this in combination with an extended period of low availability of belly capacity due to low frequency of passenger travel has led also in the airfreight market to capacity shortage and high freight rates.

“Similar to the situation in sea freight, a favorable service mix, strong development in the trans-pacific market, unprecedented access to charter capacity and operational efficiency under the difficult circumstances contributed to significantly increased margins.”

As the industry benefited from the bounce back in both demand and capacity, overall the top 25 last saw their air cargo volumes increase by 19.2% to 18.1m tonnes compared with those companies occupying the top 25 spots in 2020.

Other noticeable came from the Japanese forwarders as they reported above market improvements in air cargo demand, CH Robinson as it recovered from a particularly difficult 2020, and DSV which saw its growth lag behind that of its rivals following on from years of acquisition fuelled growth.

2021, in its first quarter, witnessed forwarders report below market growth as it was impacted by discontinued Panalpina business following the integration. However, the company recovered later in the year in line with the market.