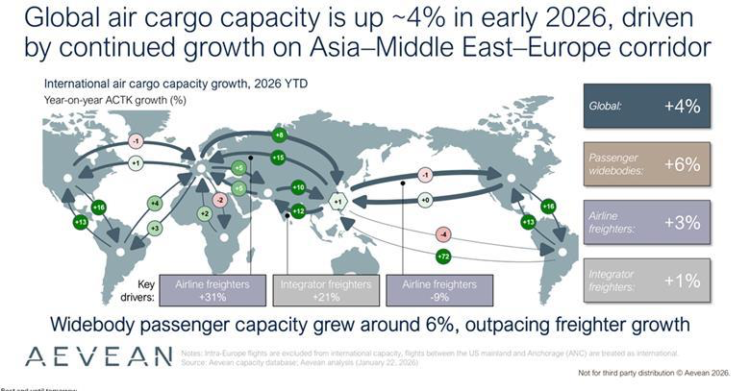

In the first weeks of 2026, global air cargo capacity rose 4% year on year, yet carriers are realigning their networks as the transpacific market sees a slight contraction. Freighter operations from Asia to North America fell 9%, while capacity between Asia and Europe surged 31% and Asia–Middle East lanes grew 12%, reflecting shifting trade priorities. Bellyhold cargo continues to underpin growth, rising 6% year on year, as carriers balance network optimisation with rising demand across intra-Asia and intercontinental routes. With global aircraft shortages and a backlog exceeding 17,000 planes, analysts warn that 2026 could see further capacity pressure, compelling airlines to strategically deploy freighters and integrate passenger bellyhold to maximise efficiency across key global lanes.

Global air cargo capacity has seen a modest increase in the opening weeks of 2026, yet airlines are increasingly redeploying resources away from the transpacific market, according to industry data. Analyst and consultant Aeveanreports that global air cargo capacity rose by 4% year on year between 1 January and 22 January, reflecting both fleet expansion and growing bellyhold utilisation.

Shift in Trade Lane Focus

While overall capacity is rising, the distribution of cargo space reveals a clear strategic shift. Capacity between Asia and Europe surged 15%, while Asia–Middle East routes grew by 12%. On the Americas lanes, capacity from North America to South America increased 16%, with the reverse direction rising 13%. By contrast, the world’s largest air cargo trade lane, Asia–North America, saw a 1% contraction in total capacity.

The trend highlights a pronounced redeployment of freighter aircraft: freighter capacity from Asia to North America fell by 9%, while Asia–Europe freighter capacity jumped 31%, signalling a strategic reallocation of high-value cargo flows. Meanwhile, bellyhold space continues to underpin growth, rising 6% year on year, supported by a 3% expansion in freighter capacity and a 1% increase from integrators.

Aligning Capacity with Early-Year Demand

The overall capacity increase broadly aligns with early 2026 demand trends. Data from WorldACD indicates that air cargo volumes rose 5% year on year in the first full week of January, suggesting that carriers are maintaining a careful balance between capacity deployment and market demand.

Industry Outlook

The shifting landscape comes as IATA issued cautionary guidance late last year regarding potential cargo space constraints in 2026. Julia Seiermann, IATA’s Head of Industry Analysis, noted that ongoing global aircraft shortagesare exerting pressure on the sector. According to Seiermann, the global aircraft order backlog now exceeds 17,000 units, equivalent to nearly 60% of the active fleet and eleven times the annual delivery rate, highlighting the long-term supply challenges facing airlines.

As the air cargo market navigates these shifts, carriers are recalibrating networks to optimise profitability, respond to evolving trade flows, and leverage growing e-commerce and intra-Asia demand while carefully managing capacity on transpacific routes.