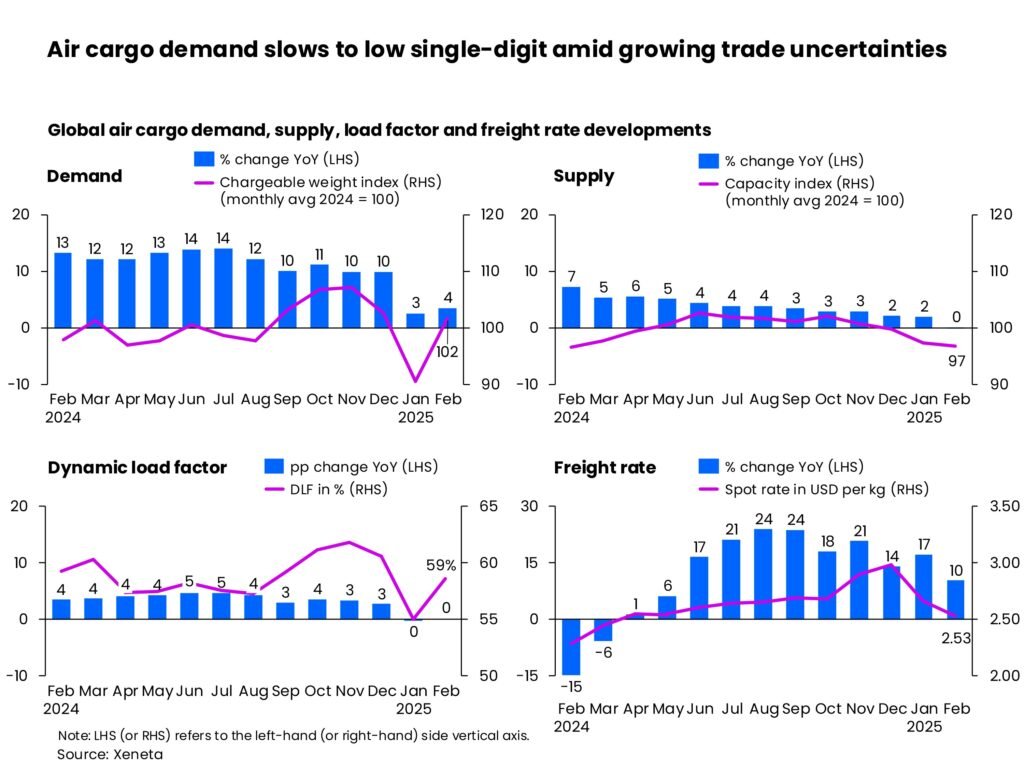

Trade Tensions Start to Shake Air Cargo Markets

A sharp -29% drop in Shanghai-to-US spot rates (USD 3.23 per kg) in February suggests global trade policies are starting to impact air cargo, according to Xeneta. Seasonal factors like the early Lunar New Year played a role, but analysts point to the US’s temporary removal of the de minimis exemption on Chinese shipments as a key factor.

“Shanghai is feeling the impact first,” said Niall van de Wouw, Chief Airfreight Officer at Xeneta. With e-commerce volumes shifting back to Hong Kong and southern China, Shanghai’s role as an alternative hub is weakening.

Shanghai-to-Europe rates dropped just -2%, but global demand growth slowed to +4% year-on-year in February, down from 2024’s strong performance.

Trade Uncertainty Reshapes Air Cargo Trends

With shifting regulations and tariffs, shippers are holding off on long-term commitments. “If e-commerce declines further, global freight rates could take a serious hit,” van de Wouw warned.

Meanwhile, the Transatlantic market remains strong, with rates up 20% year-on-year, while backhaul routes from North America and Europe to Northeast Asia saw double-digit declines.

What’s Next?

- Airlines may shift freighter capacity toward Southeast Asia or the Transatlantic.

- Freight Forwarders are delaying Block Space Agreement (BSA) negotiations.

- Shippers are opting for short-term contracts to mitigate financial risk.

Adding to the uncertainty, proposed US port call fees on Chinese-built ships could disrupt ocean shipping, temporarily pushing more cargo to air.

“With trade policies in flux, stakeholders are navigating an unpredictable market,” van de Wouw concluded.