Hong Kong is entering a decisive phase in its maritime and logistics evolution, scaling up green fuel infrastructure while modernising cargo and intermodal networks to meet tightening decarbonisation standards and shifting regional supply chains. Regulatory reform, operational deployment of alternative fuels and renewed investment in logistics capacity are converging to reposition the city as a low-carbon gateway for high-value trade across Asia.

Green maritime fuels move into operational reality

What was once confined to pilot projects has now moved into day-to-day operations. Liquefied natural gas (LNG) and green methanol bunkering are operational in Hong Kong, supported by new regulations and formal codes of practice that provide clarity for shipowners, bunker suppliers and terminal operators. Commercial LNG bunkering has been regularised following a series of ship-to-ship demonstrations since early 2025, while biodiesel deliveries have reached record volumes, signalling growing demand for diversified fuel options.

The transition is reshaping port operations. Methanol bunkering, in particular, requires new mass-flow metering systems, additional storage capacity in industrial zones and adjustments to anchorages and fairways. To encourage early adoption, policy measures have been introduced to lower entry barriers, including incentive schemes for first movers and duty exemptions for methanol used by outbound vessels. These steps align local operations with emerging global frameworks for maritime decarbonisation and provide ship operators with greater certainty on fuel availability.

Beyond physical bunkering, Hong Kong is laying the groundwork for a green maritime fuel trading hub. As emissions regulations tighten and compliance costs rise, demand is expected to grow for transparent pricing and reliable access to low-carbon fuels. Hong Kong aims to leverage its established financial infrastructure, free capital flows and legal framework to support trading activity as the market matures. Early cross-border engagement between fuel suppliers, traders and shipping interests has already begun, reflecting expectations that green fuel trading will become a core maritime service rather than a niche activity.

Logistics modernisation and intermodal reach

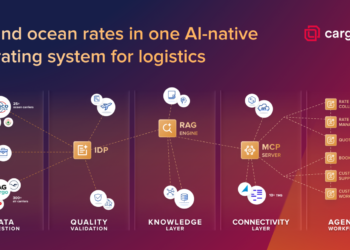

Parallel to developments at sea, Hong Kong’s logistics sector is undergoing structural modernisation. Digitalisation initiatives are being rolled out to help logistics providers—particularly small and medium-sized enterprises—adopt smarter workflows, improve data interoperability and access value-added services. Advisory support, subsidies and training programmes are accelerating the shift from fragmented, paper-based processes to integrated digital platforms capable of supporting e-commerce, time-critical shipments and temperature-sensitive cargo.

Land supply is another critical lever. Logistics sites near the Kwai Tsing port area are being redeveloped and released in phases, creating space for modern warehouses and consolidated distribution centres. New logistics clusters planned in the Northern Metropolis are expected to improve throughput efficiency and support automation, particularly for high-value and cold-chain cargo.

Intermodal connectivity remains a strategic differentiator. Rail-sea-land-river links are being strengthened to extend Hong Kong’s cargo hinterland deeper into Mainland manufacturing regions, including western provinces. Policy adjustments are also expanding air cargo transhipment arrangements to cover sea-to-air and sea-to-sea movements, reducing regulatory friction and improving flexibility for shippers. Major cross-boundary infrastructure continues to play a role in integrating cargo flows across the wider Pearl River Delta.

Reinforcing international maritime centre credentials

These developments are reinforcing Hong Kong’s standing as an international maritime centre. The city continues to host a dense concentration of maritime services, spanning ship management, brokerage, insurance, finance and technical support. Its ship registry remains a key competitive asset, supported by incentive schemes that reward high-quality tonnage, strong safety records and improved environmental performance.

New incentives linked to vessel efficiency and emissions performance complement the city’s expanding green bunkering capability. Together, they create a more complete ecosystem for shipowners planning long-term fleet deployment in Asia—combining quality flag administration, access to alternative fuels and a broad base of professional services.

The broader policy framework integrates five pillars: green fuels, green ports, green incentives, green collaboration and green expertise. Measures range from streamlined approvals and expanded fuel storage to workforce development aimed at building specialist skills in green maritime operations. Regional collaboration is also on the agenda, with plans to develop green shipping corridors that align vessel operations and port standards across multiple jurisdictions.

As global shipping and logistics move toward lower-carbon models, Hong Kong’s strategy reflects a clear direction of travel. By pairing operational readiness in green fuels with digitalised logistics and deeper intermodal integration, the city is positioning itself not just to comply with new rules, but to capture emerging trade flows in a more complex, sustainability-driven maritime economy.

Key takeaways – Hong Kong is rapidly transforming into a premier green maritime and logistics hub, driven by the November 2024 Action Plan on Green Maritime Fuel Bunkering and Action Plan on Modern Logistics Development. Key initiatives include offering incentives for green fuel adoption, developing LNG/methanol bunkering infrastructure, and promoting digitalisation and hydrogen-powered transport to achieve net-zero carbon emissions by 2050.

Green Fuel Adoption and Maritime Upgrades

- Green Fuel Bunkering Action Plan: Aiming to become a top-tier green maritime fuel centre, the government launched an incentive scheme for ships to use low- or zero-carbon fuels, with targets to reduce international shipping emissions by at least 20% by 2030 and 70% by 2040.

- Infrastructure & Support: A dedicated land parcel near the port is being prepared for green fuel storage, with the first LNG ship-to-ship bunkering demonstration expected by mid-2025.

- Incentives: The Green Maritime Fuel Bunkering Incentive Scheme will provide up to $1 million per enterprise to pioneers in green fuel bunkering.

- Regulatory Changes: The Marine Department is releasing a Code of Practice for Methanol Bunkering and allowing non-locally registered vessels to provide services temporarily.

Logistics Modernisation and Sustainability

- Digitalisation & AI: The Action Plan on Modern Logistics Development promotes 4PL services, Internet of Things (IoT), and data analytics to improve supply chain efficiency and transparency.

- Hydrogen and EV Adoption: Eight new trial projects for hydrogen fuel cell (HFC) goods vehicles and coaches were approved in April 2025. Additionally, the city is transitioning to electric taxis, aiming to reach 3,000 by 2027.

- Multimodal Connectivity: Strengthening the “Railway-Sea-Road-River” green corridor to enhance regional connectivity.

- Talent Development: The government is promoting professional training to support the transition to high-quality, sustainable logistics.

These measures aim to ensure Hong Kong remains a competitive, modern, and sustainable international logistics hub.