The global air cargo market may have to ‘hang on until October’ for signs of recovery after a flood of summer belly-hold capacity on major lanes and a -4% drop in demand in April indicated a challenging 4-5 months ahead, according to new weekly analysis from CLIVE Data Services, part of Xeneta.

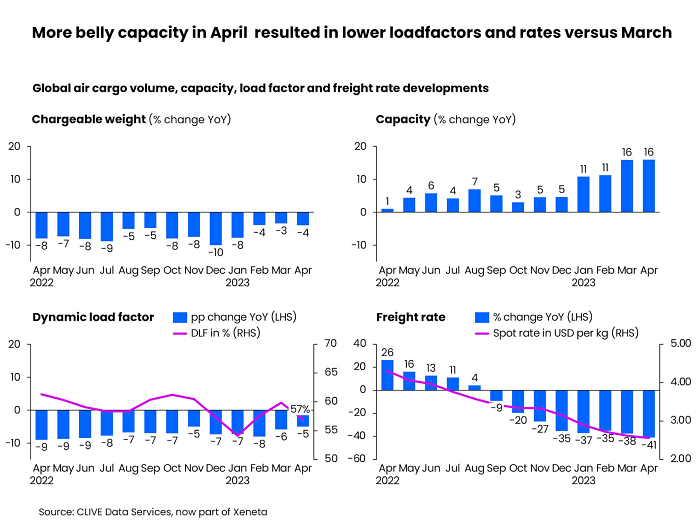

Airfreight spot rates dropped -41% versus April 2022 as a 7% rise in cargo capacity resulted in lower load factors and a fourteenth consecutive month of falling volumes year-over-year. CLIVE’s dynamic load factor, measuring global volume and weight perspectives of cargo flown and capacity available, dropped -5% pts versus 2022 to 57% in April, continuing a more than year-long decline.

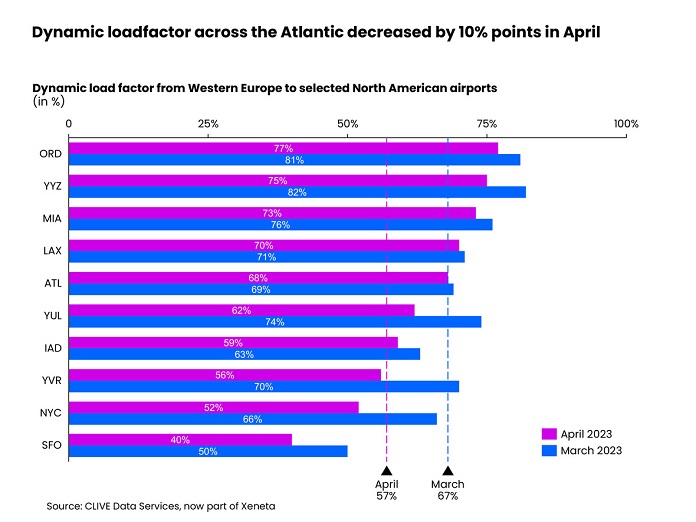

Summer capacity had its traditionally profound impact on the air cargo market from Europe to North America, with capacity up 26% in comparison to March 2023. Data showed a 10% pts decrease in load factor across the North Atlantic to 57% last month, compared to the 67% level recorded by major North American airports in March. This pushed the general airfreight spot rate on this westbound lane down to USD 2.29 for April.

While air cargo market performance in April recorded a level of seasonality expected for the time of year, volumes were also impacted by the Easter, Eid, Pesach, and Ramadan public holidays all coming together so closely – but, this didn’t disguise the dwindling market conditions, says Niall van de Wouw, Chief Airfreight Officer at Xeneta.

“This is a market that will test companies. If you look at Europe-North America, what other industries see supply increase from one month to the next by 26%, very much outside of their control. This is a tremendous jump in capacity and, consequently, we saw a corresponding -12% fall in spot rates on these routes.“Shippers will be happy, freight forwarders less so, while the strong return of the leisure passenger market, and signs of improving corporate travel and lower fuel prices, is making passenger airlines upbeat and providing the long-awaited boost they needed. Of course, we should not forget that freight rates are still elevated but the influx of belly capacity this summer means the air cargo market may have to hang on until October, when winter schedules begin and capacity is reduced, for the next signs of an upturn in volumes and yield,” he stated.

Whether a rise in demand comes in Q4, as the industry anticipates, however, remains increasingly uncertain. “If you listen to their earnings calls, you’ll hear shippers pushing back on expectations of a big inventory replenishment later in the year. So, these are really tough times for air cargo. The market is in the doldrums; we do not currently see this changing until much later in the year or early 2024. The air cargo market is readjusting and this will also open up new opportunities, but we see a difficult few months ahead. Right now, we don’t see any ‘ripples on the water’ to indicate more wind to give the market an uptick in volumes in the near future, ” van de Wouw added.